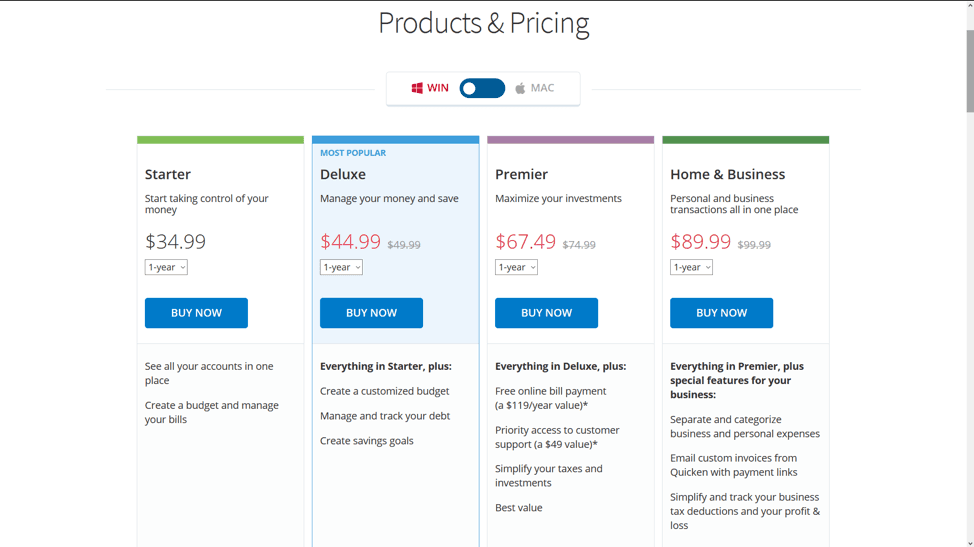

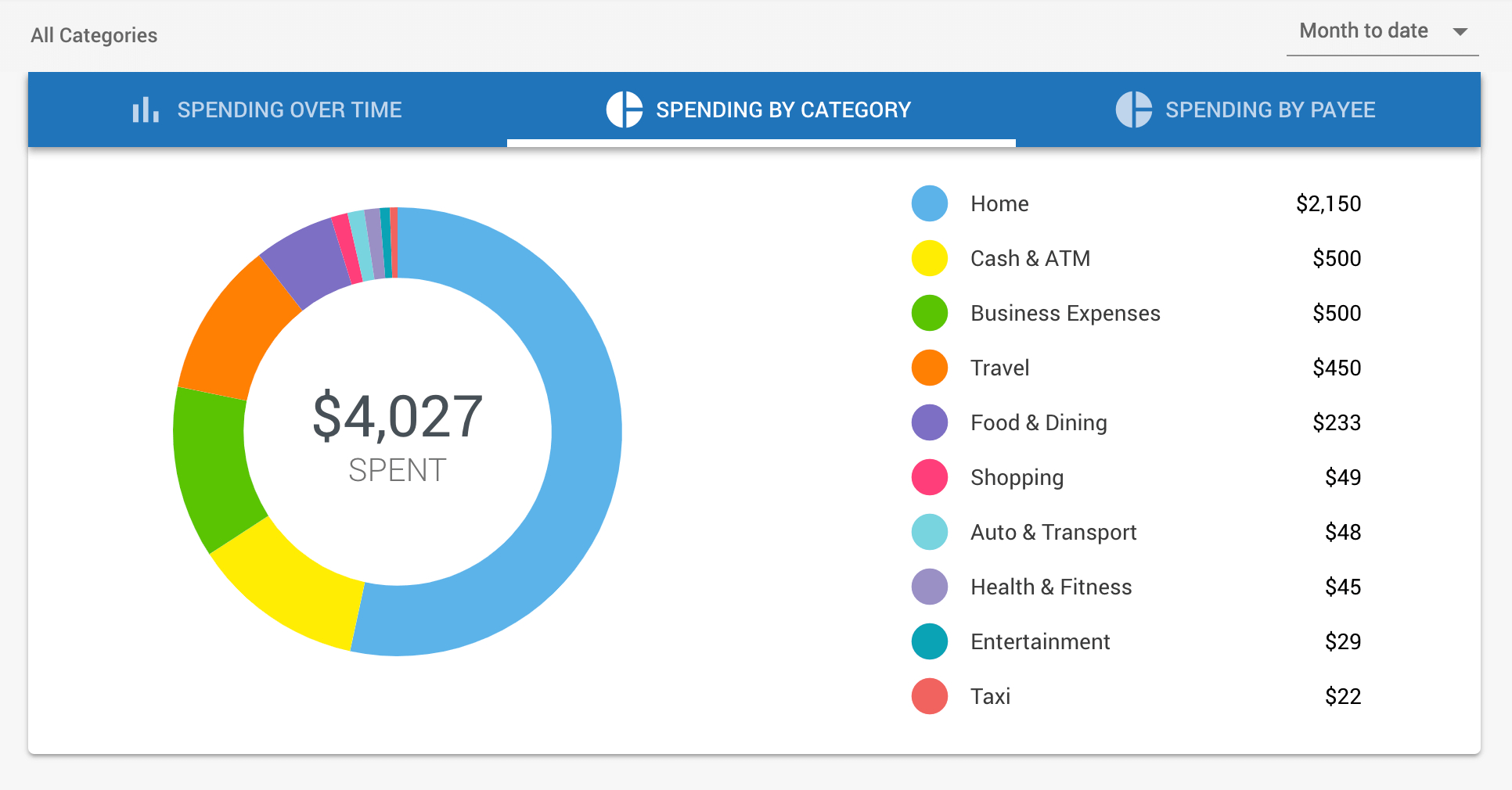

Why? Because personal finance is…well, personal.īudgeting is much the same. If you narrow the options and ask them to choose between Mint and Quicken, the responses will probably be split right down the middle. If you ask ten different people to name their favorite budgeting tool, there’s a good chance you’ll get ten different answers. Technology is helpful, but budgeting still takes work. Because it’s free, Mint offers an excellent, no-risk option for anyone looking for a little guidance on their budgeting journey. Excellent for keeping track of day-to-day spending and monthly obligations, Mint lets users stay up-to-date with their finances without bogging them down with more features than they need. Mint: It’s not necessarily the “new kid on the block,” but Mint’s fee-free availability and mobile convenience make it the go-to budgeting app for a growing number of users from multiple age demographics. Although some people may view the price tag as a deal-breaker, for the right user, the cost is well worth the investment. With bill pay features and retirement planning options, Quicken allows users to manage immediate financial obligations while planning for the future as well. Its extensive feature offerings make it easy for individuals to keep track of their personal or business finances all in one convenient program. Quicken: While it may be considered “old school,” Quicken has remained one of the world’s most popular financial management tools for good reason. Oh, and did we mention it’s free? Quicken vs. User-friendly budgeting tool for anyone who wants to manage their day-to-day finances more effectively. Secured with 256-bit encryption & multi-factor authentication.Customizable email or text alerts for bills and transactions.

Quicken mint bills software#

Quicken mint bills Pc#

To help clear up that confusion, let’s take a look at two of the most popular budgeting tools on the market today: Quicken and Mint. There are so many to choose from that the decision can be confusing. Whether you’re trying to establish a budget for the first time or climbing back in the saddle for another attempt, you might be wondering which budgeting tool is best for you. Why is such a simple habit so difficult to maintain? In many cases, the difference between good intentions and budgeting success comes down to the budgeting tools you use. Maybe you’ve tried using one before and failed. Junior Term Share Certificates menu itemīudgets are nothing new.Savings or Certificate-Secured Loan menu item.Motorcycle & Recreational Loans menu item.

0 kommentar(er)

0 kommentar(er)